Q: I’m doing some family home improvements this present year, and you can I am not sure how-to funds every thing. Create I take out financing? Ought i merely fees all expenditures on my bank card? There are a lot possibilities! Which one helps make the really feel getting my personal earnings?

A: Whether you’re gutting all of your kitchen otherwise simply springing to own a great fresh finish regarding paint and you can new fixtures, Azura enjoys you covered. During the Azura Borrowing from the bank Commitment, you really have a number of options with respect to resource a home repair. You could unlock a beneficial HELOC, or property Guarantee Credit line, which is an unbarred credit line which is shielded by the house’s worth for as much as ten years. You’ll be able to finance your own home improvements having an individual or unsecured mortgage, make use of playing cards otherwise use a retail charge card that’s associated with a home-improve store, like Lowe’s or Domestic Depot.

Among the best an easy way to loans a property repair is actually if you take out a house Equity Loan. Let us take a closer look at this preferred mortgage and its particular advantages.

What exactly is a home collateral mortgage?

A property equity financing are financing secure by an effective residence’s really worth. It means your house functions as guarantee to the mortgage and you can promises the money borrowed.

Whenever individuals discover a property collateral mortgage, they located a fixed sum of money in one single lump share. Extent they are going to qualify for was computed according to the home’s financing-to-really worth (LTV) proportion, percentage label, money and you can credit history. Really home security money, also people offered by Azura, possess a fixed rate of interest, a fixed title and you will a fixed monthly payment.

Do you know the advantages of a home equity financing?

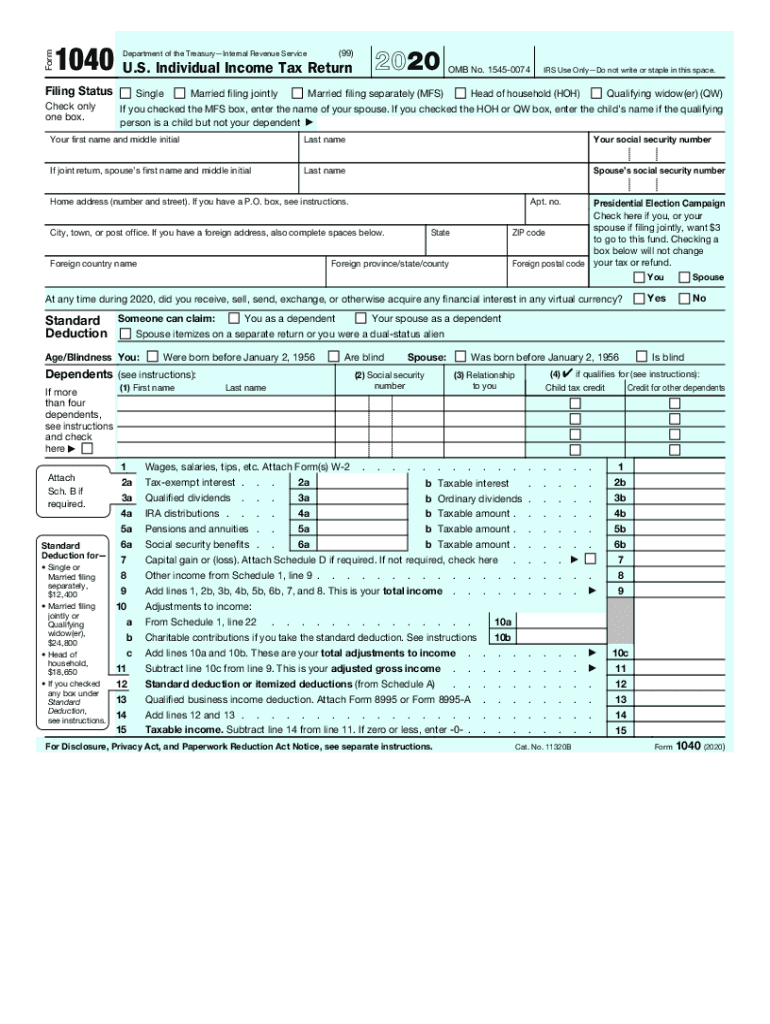

The primary benefit a property security loan keeps more than most other loans, like the HELOC, was their fixed interest rate. This means brand new borrower knows how much the new payment per month could be for the entire longevity of the loan, and work out cost management on money smoother. This might be particularly beneficial in a world of rising rates of interest once the borrower’s loan isnt subject to the brand new growing rates of variable fund. In addition to, the interest repaid to your a home security financing is commonly 100% tax-allowable (check with your income tax agent to have facts).

A different advantageous asset of property security mortgage is actually their uniform repayment package on the longevity of the loan. In the place of a beneficial HELOC, which in turn only means repayments to the the newest loan’s attract while in the its very first 5 years, consumers would be to make payments into the new loan’s interest and you may dominant regarding the longevity of the borrowed funds. Certain funds, like those at the Azura, even make it borrowers to invest straight back big figures if they favor, no matter if of numerous tend to costs a penalty to have very early costs. No matter what lender’s rules, after the loan identity, the whole amount due was paid-up.

Any kind of downsides of a property guarantee mortgage?

When you’re a property guarantee financing also offers borrowers entry to the cash needed seriously to shelter do-it-yourself systems that have an inexpensive fees package, it is important to find out about every aspect of the mortgage prior to implementing.

Some tips about what you need to know:

Taking right out a house equity loan mode investing multiple costs having this new privilege of credit currency resistant to the home. It’s best to learn more about these costs and exactly how far they will certainly amount to in total before personal loan in Windsor applying for a loan.

And, when starting a house security mortgage, borrowers get most of the financing in one try. This makes a home security loan a option for home owners which know exactly what type of performs they will certainly would into the their houses while the projected full costs for that actually work.

For folks who only have a vague tip about which renovations you can create as well as how far they will rates, you ount of cash. Unlike good HELOC, because the loan was applied for, there is absolutely no means to fix increase the matter.

Fundamentally, consumers will have to generate a payment for the financing, irrespective of their financial condition during the time. Once they default for the financing, they might eliminate their residence. Because of that, before you take aside property security mortgage, individuals should make sure they are able to spend the money for monthly payments on the the mortgage.