An overview of House Depot Loans

Your house Depot Providers has the benefit of worthwhile resource choices to its customers. People to get units, equipment, and you will do it yourself things are able to use capital choices offered by Family Depot.

It is a convenient way for customers because they do not must make an application for 3rd-people financial support. Family Depot has the benefit of financing with regards to leading individual and you may investment borrowing notes which have differing loan words.

The mortgage app procedure is not difficult and you may people can put on on line otherwise by visiting a shop. The program recognition conditions, interest rates, or any other requirements are different for the certain issues (talked about below).

Domestic Depot Bank card

Citi bank. Although not, instead of almost every other playing cards, they can only be useful for searching at the Household Depot stores and you will online websites.

This charge card also provides 0% rates in the event the customers pay-off the full count contained in this half a year. Although not, you’re going to have to spend accrued interest when you have any left harmony following promotion months.

- 0% focus in the event the paid off within half a year of marketing several months on sales from $299 or higher.

- Adjustable Annual percentage rate getting standard repayment words of -%.

- Late Payment percentage regarding $40.

- Doing 24-days off installment words with respect to the credit number.

- No yearly charges.

Family Depot Endeavor Mortgage Mastercard

The house Depot endeavor mortgage is actually for people selecting bigger renovations. Which financing is up to $55,100000 for your house repair and you can improve expenses.

Your panels mortgage credit card could also be used at the house Depot places getting shopping. People have as much as six months to completely utilize the approved loan amount.

- Has a credit limit out-of $55,000

- No yearly commission

- Financing regards to 66-, 78-, 90-, and you can 114-months

- Repaired APRs out-of seven.42%, %, %, and you will % respectively to possess terms in the above list.

Domestic Depot Bank card Application Processes

Users can put on online otherwise from the Home Depot areas getting its common charge card. Your house Depot credit cardiovascular system reviews apps and you can handles the borrowed funds procedure.

There’s no prequalification phase from the House Depot financing features. It means there are a hard credit query after you apply for a credit card our home Depot.

The true criteria together with recognition procedure is dependent upon of many points including your earnings, borrowing from the bank profile, and you may prior records.

Family Depot Mortgage Denied 5 Reasons You need to know

Even though you completed all the info and paperwork requirements, there’s no make certain that your property Depot enterprise loan usually be approved.

Less than perfect credit Score

The home Depot and its own financing partner often assess your borrowing rating like any other lender. There’s no reference to minimal credit history requirements commercially whether or not.

However, when your credit history are bad, it is likely that the loan software could be rejected. In case your other comparison metrics try important, then you’ll definitely you desire a higher still credit score to progress which have an application.

Warning flags on your Credit score

Loan providers glance at your credit history to assess your history. He’s always keener to learn the way you reduced your earlier fund.

Should your credit rating shows late monthly installments, delay costs, standard, or bankruptcies, your odds of loan recognition is narrow.

Your debt-to-Money try High

Your debt-to-money ratio reveals simply how much of one’s gross income is certainly going to your monthly mortgage payments. It indicates in the event it ratio was large, you have got check loans Elizabeth a small support to help you serve another loan. Like most most other bank, Home Depot will additionally be interested observe a diminished loans-to-money ratio in your borrowing character.

A primary reason for one mortgage rejection is that your income resources is actually unpredictable. It means you don’t have a guaranteed or long lasting money resource.

It sounds also noticeable but you could have considering the new incorrect information regarding the loan software that could result in an effective getting rejected.

Instance, you may also go into the specifics of good cosigner and go wrong. Also, one omission otherwise problems on the loan applications can lead to that loan getting rejected also.

How-to Change your Acceptance Potential at your home Depot?

You can re-apply from the Household Depot to have a unique project mortgage otherwise a consumer credit cards when. However, it will affect your credit score as it incurs an arduous pull and you may decreases your credit rating.

Selection so you’re able to Household Depot Venture Financing

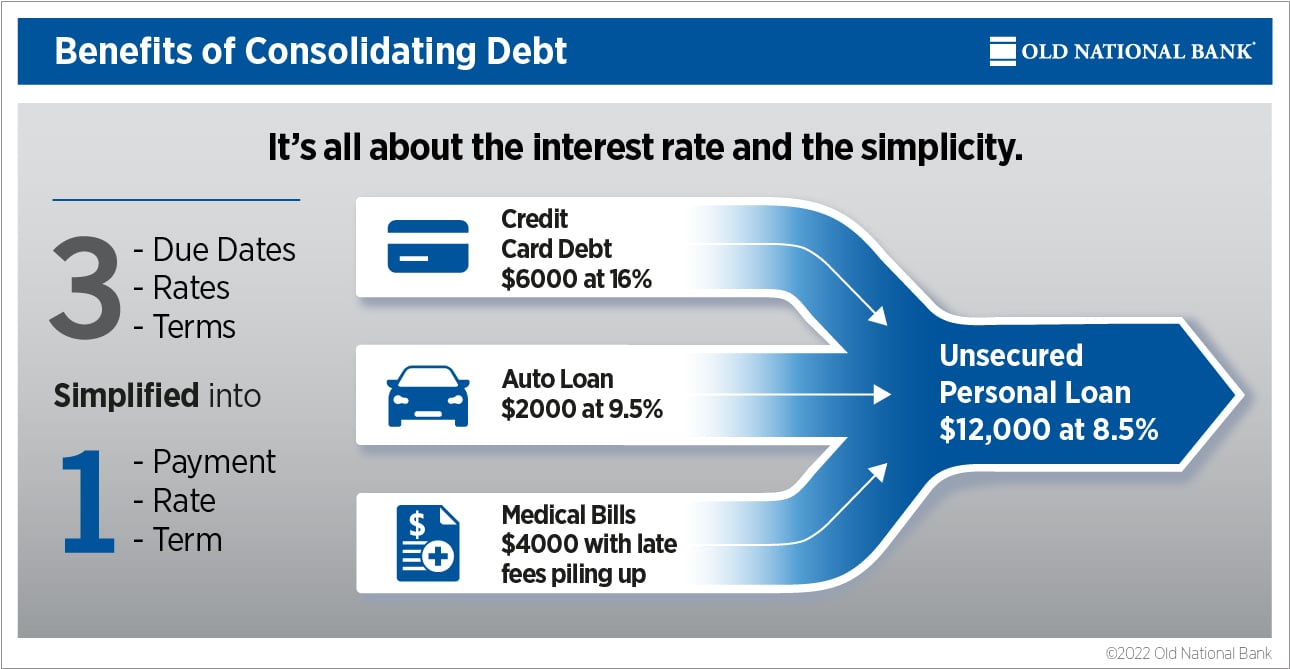

Reapplying in the Home Depot getting a venture loan can cost your credit rating things. You can test a few choice towards the credit rating cards as well as the opportunity mortgage.

Envision virtually any do it yourself loan supplied by a professional lender, borrowing from the bank relationship, otherwise personal financial. Particular lenders take on loan requests with various acceptance criteria.

You could take a far more traditional way of financing your residence advancements through the use of to possess a home personal line of credit or range of collateral based on your position.

When you have oriented domestic guarantee, it can be utilized once the a hope in order to safe your own mortgage. You need it approved consumer loan for your goal in addition to your property upgrade conditions.

Fundamentally, in the event your latest financials don’t let for a different financing, you might re-finance one of the existing funds. You might refinance a personal bank loan, a mortgage, otherwise credit card fund to create a support for your do-it-yourself commands.