Whether you are buying your first otherwise next family otherwise was spending inside the a home, and are generally needing a mortgage, we have been here to aid. The next tips provides you with an indication of our very own techniques getting a professional family.

Call all of our devoted financial experts with the 1300 747 747 Mon-Fri 9am-5pm AEST otherwise plan a scheduled appointment at the nearest part.

Our very own credit party can assist understand what mortgage options are most appropriate to you considering your current financial predicament, criteria and you will objectives.

We shall comment your application and you may create an initial article on your conditions. In the event the everything’s ok we’ll citation this on to a credit Assessor getting an entire testing and you will recognition.

An effective Conditional Recognition might be given even as we manage the property is cherished, and we’ll show if whatever else are a great.

Whenever we has actually what we you prefer your application can be just do it and you may we shall matter your that have a proper recognition. Right now, our attorneys tend to matter the loan package which has the fresh new certified financing offer.

When you receive the financial pack, cautiously look at the loan arrangements and you will conditions and terms before signing brand new files. Following go back them according to the solicitor’s recommendations to arrange settlement.

We’ll need a duplicate of the Total Homeowners insurance ahead of payment. You could potentially come across your own insurance provider otherwise we could arrange so it by way of all of our companion Allianz.

When selecting property, the solicitor or conveyancer will tell the attorneys who to blow. Shortly after settlement, the property might possibly be gone to live in your own name and we’ll check in the loan.

If you’re refinancing, the new proceeds could well be paid to the outbound financial institution, right after which the loan might possibly be given out and you can closed. We’re going to then discharge one other bank’s home loan and you may register our very own home loan.

Done well, you accomplished the house loan processes! For all the inquiries in your new home financing, label our home mortgage experts on the 1300 747 747.

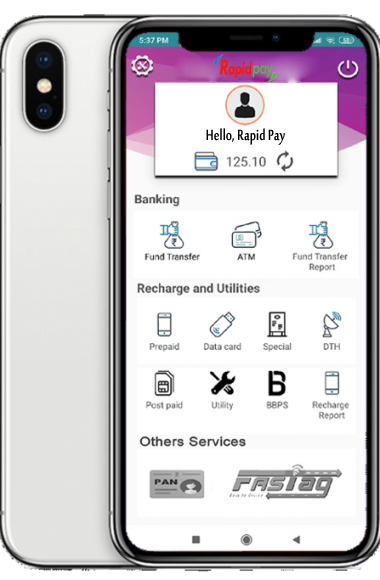

You can take control of your loan through on line financial or perhaps the Qudos Bank software. To set up counterbalance levels otherwise make changes toward loan delight publish a safe Mail or telephone call 1300 747 747.

Mortgage Procedure Frequently asked questions

All of the customer’s means are very different therefore the correct mortgage for you will trust a variety of affairs, including your finances and also the particular property you are to invest in. To start looking for the right mortgage, we recommend examining the house financing review page.

When finding the optimum loan for your requirements, we’ll give you an amount borrowed according to debt state, criteria, and objectives. Although not, if you want an offer of the borrowing from the bank energy, you need to use the on the internet borrowing from the bank strength calculator. It tool takes into account your revenue, expenses, or other monetary information to provide an idea of how much you will be capable obtain. Just remember that , it is merely an offer, plus actual borrowing from the bank energy can be additional centered on an effective more descriptive investigations of your own financial predicament.

The financing pros are also available to talk about your specific need which help you understand your own credit fuel in more detail, as well as ideas on how to assess your property loan money.

There is certainly individuals records that you’re going to need certainly to offer included in the mortgage application processes, including:

- Identification: To apply for a mortgage, you’ll want to offer identification data files like your passport, driver’s licence or delivery certificate. These types of data files help to make certain their name and make certain your permitted sign up for a mortgage. If you’re not an enthusiastic Australian resident, it’s also possible to must provide even more documents to possess a property loan application, just like your visa or home condition.

- Income: You’ll need to render proof of your revenue, that could are pay slides, tax returns otherwise lender statements. These data files help to show the lender that you have an everyday and you will sufficient earnings to repay the borrowed funds. When you’re notice-employed, you may need to render most records including company income tax yields otherwise monetary comments. Additionally, for people who receive any other resources of money, for example local rental money otherwise regulators experts, you can need certainly to promote evidence of these types of.

- Expenses: You will need certainly to provide information on their expenses, and additionally one existing expense such as credit cards, car and truck loans or unsecured loans. This particular article assists the lending company to evaluate your capability to pay back the borrowed funds and find out if you can afford the new repayments. You may need to give statements otherwise documents for your costs, as well as payment schedules for present expenses.

- Additional information: Based your individual affairs, you’re necessary to render addiitional information for example proof away from offers, details of people property or liabilities, otherwise information about your work records. This post really helps to make an entire image of debt disease and you will means you’re the right applicant getting property financing. Such as for instance, if you are having fun with a current possessions which you own once the protection toward loan, you will need to provide facts about you to definitely possessions, for example the well worth and you can any a fantastic loans. While strengthening an alternate domestic, at the same time, you may have to bring plans and you can criteria, together with estimates or statements regarding builders and builders.

Conditional recognition ensures that a loan provider keeps examined a great borrower’s mortgage application and that is ready to render them financing, susceptible to particular criteria being came across. Such criteria are normally taken for taking additional files, such proof income otherwise a position, or delivering further information concerning possessions are bought. Since the debtor have came across these criteria, the lender will promote an unconditional recognition.

Unconditional acceptance, called official otherwise full recognition, means the lender has actually completed a full testing of the borrower’s loan application in fact it is prepared to promote all of them a loan. During this period, the financial institution enjoys completely affirmed the fresh new borrower’s income, work, credit rating, and other relevant recommendations, and has now figured the borrower suits all of their financing requirements.

An excellent guarantor toward home financing is someone who agrees for taking obligations to own good borrower’s home loan if your borrower struggles to make their loan repayments. Essentially, a great guarantor is actually an effective co-signer to your loan, just who will bring a guarantee into the bank they can cover the newest financing money in the event the debtor cannot.

Most of the time, a guarantor are a member of family or friend of debtor who has an effective credit rating which will be willing to fool around with her domestic, due to the fact shelter with the loan. The latest guarantor is largely pledging their unique property just like the equity within the case the debtor non-payments on financing.

Which have a great guarantor to the home financing is a great idea getting consumers who’ve a low-income or restricted deals, as it could make it easier for them to qualify for a mortgage. It can also help individuals stop purchasing loan providers home loan insurance policies (LMI), that is always needed for consumers that have a deposit of less than 20% of one’s property’s well worth.