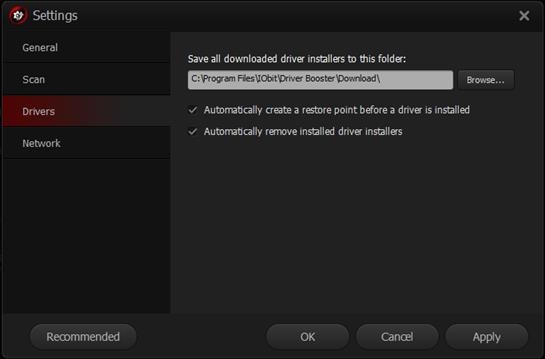

Consult because of the email address

1. Consumer’s root payment authorization or instrument nonetheless called for. The fresh customer’s agreement necessary for 1041.8(c) is actually introduction so you’re able to, and not in lieu of, any separate fee consent or appliance expected to be purchased out of the consumer around applicable laws and regulations.

step 1. General. Area 1041.8(c)(2)(i) kits ahead all round requisite you to definitely, getting reason for the newest difference inside the 1041.8(c), this go out, number, and you may fee route each and every more commission import should be licensed of the consumer, subject to a restricted different for the 1041.8(c)(2)(iii) getting percentage transmits exclusively to collect a later part of the commission otherwise returned item percentage. Appropriately, on the exception to put on so you’re able to an extra commission transfer, the fresh new transfer’s particular go out, number, and you can commission station have to be included in the signed authorization acquired regarding consumer less than 1041.8(c)(3)(iii). For recommendations on the requirements and problems that implement when acquiring the brand new client’s closed agreement, discover 1041.8(c)(3)(iii) and you may accompanying comments.

Particular big date

2. The necessity that the particular day each and every most fee import getting authorized by the user are met whether your user authorizes new day, time, and you will seasons of every import.

3. Count bigger than certain amoun t. The latest exemption from inside the 1041.8(c)(2) will not apply in the event your financial starts a fees import having an amount larger than this amount authorized by the individual. Properly, such a move create break the new ban into the a lot more fee transmits not as much as 1041.8(b).

4. Smaller amount. A cost import initiated pursuant to 1041.8(c) is established to your certain amount authorized by the consumer in the event that their count is equal to otherwise smaller compared to the fresh signed up amount.

step one. General. In the event that a lender gets the fresh consumer’s agreement so you’re able to initiate a fees import exclusively to collect a late percentage otherwise returned item percentage in accordance with the criteria and you may criteria not as much as 1041.8(c)(2)(iii), all round requirements during the 1041.8(c)(2) your individual approve the particular big date and you can amount of for every additional commission import doesn’t have to be satisfied.

dos. Higher amount. The requirement the customer’s closed authorization were a statement you to definitely specifies the best amount which is often energized having a belated fee or returned goods commission are came across, including, in the event the report determine the most permitted beneath the mortgage agreement having a secured financing.

step 3. Different percentage amounts. In the event the a fee number can differ because of the left loan balance or any other facts, this new rule requires the bank to visualize the standards you to definitely influence about higher number you’ll be able to when you look at the figuring the specified number.

1. General. 8(c)(3)(ii) to help you request a customer’s authorization toward otherwise after the big date one to the lending company contains the user legal rights notice required by 1041.9(c). Towards the exception to this rule into the 1041.8(c) to apply, not, the client’s closed consent must be gotten no prior to when this new go out on which an individual is recognized as to have gotten the brand new individual legal rights find, given that given from inside the 1041.8(c)(3)(iii).

2. Different alternatives. Little for the 1041.8(c)(3)(ii) forbids a lender regarding bringing different options for the user so you’re able to believe depending on the time, amount, otherwise fee route of each and every a lot more commission import in which the brand new lender are requesting authorization. Concurrently, in the event that a customer refuses a request, absolutely nothing during the 1041.8(c)(3)(ii) forbids a loan provider of and come up with a follow-upwards request by giving an alternative number of terminology on the consumer to take on. Such as for example, in the event your consumer declines an initial consult so you’re able to approve a few repeated percentage transfers getting a Maine payday loans online bad credit certain count, the financial institution could make a follow-upwards request the consumer in order to approve around three recurring payment transfers having a lesser amount of.

1. Not as much as 1041.8(c)(3)(ii)(A), a loan provider was allowed to deliver the expected terms and conditions and you may declaration towards the consumer in writing or perhaps in a beneficial retainable function from the email if your user have consented to receive electronic disclosures in the you to fashion not as much as 1041.9(a)(4) otherwise agrees for this new terms and you can report of the email address in the course regarding a socializing started by the consumer responding on individual rights find required by 1041.9(c). Another analogy portrays a posture in which the user agrees for the desired terms and you can report of the email address immediately following affirmatively answering the newest notice: